Corporate Tax Registration In UAE

Corporate Tax registration in the UAE is a critical step for businesses looking to establish a strong financial foundation in this dynamic and thriving business environment. Bespoke Strategy Solutions, a leader in corporate tax consultancy, provides expert guidance through the intricate process of corporate tax registration.

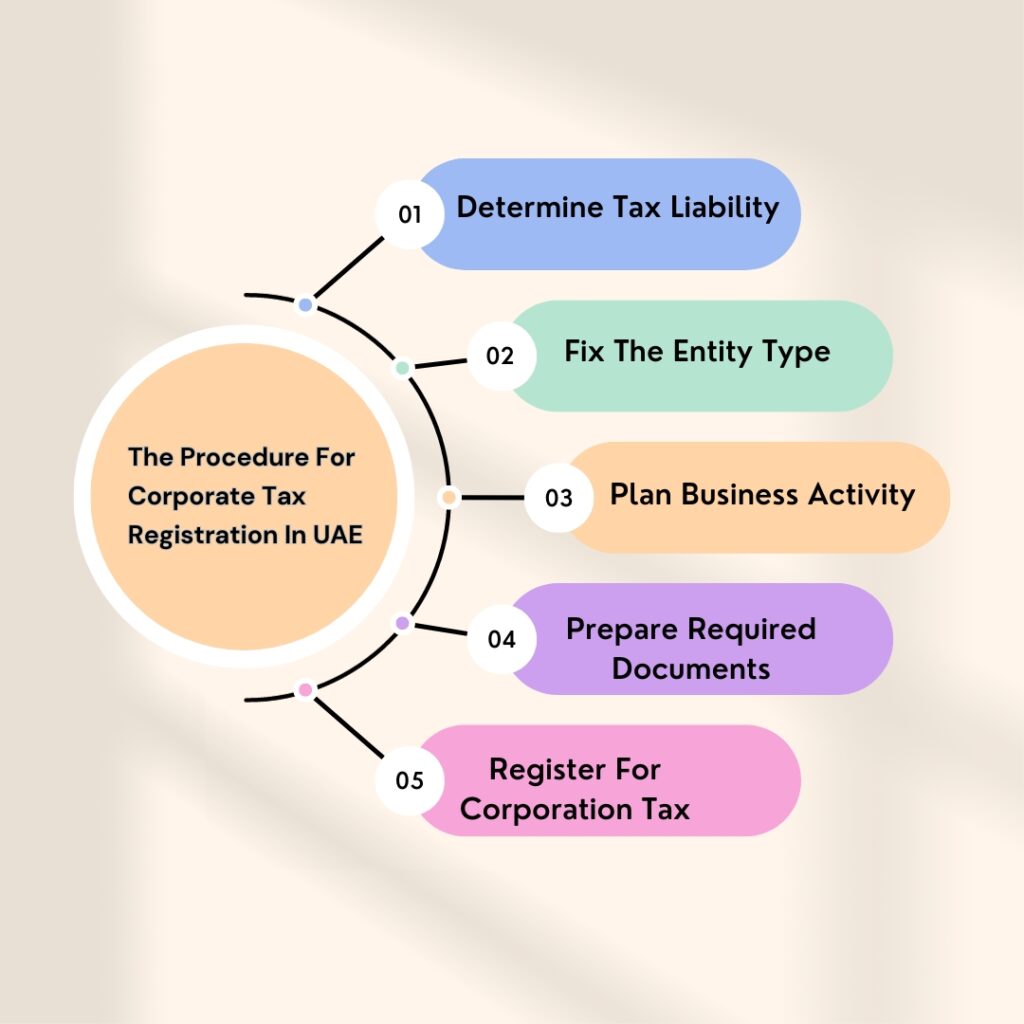

Corporate Tax Registration Process In The UAE

To register for UAE Corporate Tax, the Federal Tax Authority has introduced a streamlined process through the EmaraTax platform. EmaraTax serves as an online portal designed to facilitate various tax-related activities, including registrations, returns, refunds, deregistration, and payments – all within a single, user-friendly platform. Additionally, the portal allows for easy VAT payments.

Follow These Steps To Initiate The Registration Process:

Access EmaraTax: The first step involves accessing the EmaraTax platform, the official online portal for tax-related transactions.

Account Creation or Migration: Users can create a new account on EmaraTax or migrate their existing Federal Tax Authority (FTA) account to the EmaraTax platform. A simple EmaraTax login guide is available for assistance.

Submission of Documents: Once logged in, users will be prompted to submit all the required documents for Corporate Tax in the UAE.

Successful Registration: Complete the necessary steps, submit the required documentation, and successfully register for Corporate Tax in the UAE.

By following these straightforward guidelines on the EmaraTax platform, businesses can ensure a smooth and efficient registration process for Corporate Tax in the UAE.

Need For Corporate Tax Registration In UAE:

Understanding the need for Corporate Tax registration is crucial for businesses operating in the UAE. Bespoke Strategy Solutions emphasizes the importance of compliance with UAE tax regulations to avoid penalties and legal complications. Our comprehensive approach ensures that your business meets all requirements for Corporate Tax registration.

Who Is Exempt From UAE Corporate Tax?

Despite the Federal Tax Authority’s request for Exempted Persons to register for Corporate Tax, businesses falling under the exempted category are subject to a 0% corporate tax rate.

Several Categories Enjoy Exemptions From Corporate Tax, And A Few Are Outlined Below:

Employee Salaries: Corporate Tax does not impact employee salaries. However, individuals earning income through activities conducted under a freelancing license are liable to pay company tax.

Shares and Similar Assets: Dividends, capital gains, or any income generated by personal potential from shares or similar assets are exempt from Corporate Tax.

Real Estate Investment: Legal investment in real estate within the UAE remains exempt from Corporate Tax, as long as the investor holds no business license.

Intra-Group Transactions or Reorganizations: Corporate Tax does not affect potential intra-group transactions or reorganizations.

Foreign Investor Income: Corporate Tax is not levied on foreign investors’ income from dividends, gains, royalties, and similar investment returns unless acquired through business or business activities.

Who Should Register For Corporate Tax?

Any business entity engaged in commercial activities within the UAE is obligated to register for Corporate Tax. Bespoke Strategy Solutions provides clarity on the criteria for mandatory registration, ensuring that your business complies with UAE tax laws.

Timeline For Corporate Tax Registration:

Corporate Tax registration initiates in early 2023. As an illustration, a business with the inaugural tax period commencing in June 2023 must complete the Corporate Tax registration within 26 months, by January 2025, with the return filing deadline set for February 2025. Subsequently, upon registration, UAE businesses will be granted a nine-month window from the conclusion of the applicable tax period to submit their tax returns to the Federal Tax Authority and settle the Corporate Tax dues.

The Importance Of Corporate Tax Assessment Before Registration

Conducting a thorough assessment of a business’s risks and legal factors, both before and after the implementation of corporate tax, is crucial for ensuring compliance with the country’s tax regime. Failing to assess the corporate tax requirements beforehand can lead to potential fines and penalties.

The Corporate Tax Assessment Encompasses Various Aspects, Including:

1. Impact Assessment: Evaluating the potential impact of corporate tax on the business operations and financial structure.

2. Document Assessment: Ensuring that all necessary documents are in order and compliant with the corporate tax regulations.

3. Tax Compliance Assessment: Verifying the business’s adherence to tax compliance standards and regulations.

It is highly advisable to conduct this assessment with the assistance of professional corporate tax consultants or firms that specialize in providing quality corporate tax assessment services. By doing so, businesses can mitigate risks, avoid penalties, and navigate the corporate tax landscape more effectively.

In the subsequent sections, we delve into Corporate Tax Registration services that contribute to a seamless and efficient registration process.

UAE Corporate Tax Rate:

0% for taxable income up to AED 375,000

9% for taxable income above AED 375,000 and

Corporate Tax Rate For Free Zones:

Free Zone businesses in the UAE, including financial free zones, will be liable for Corporate Tax. Notably, the Corporate Tax regime will maintain the current corporate tax incentives for free zone businesses adhering to regulatory requirements and exclusively operating within the free zones without conducting business in mainland UAE. Entities established in a free zone must fulfill registration obligations and submit a Corporate Tax Return.

Corporate Tax Registration Services Offered By Bespoke Strategy Solutions:

As a leading corporate tax consultant, Bespoke Strategy Solutions goes beyond mere guidance and offers comprehensive Corporate Tax registration services. From document preparation to submission, our experts handle every aspect of the registration process, allowing you to focus on your core business activities.

Conclusion:

Navigating the complexities of Corporate Tax registration in UAE requires expertise and precision. Bespoke Strategy Solutions stands as your trusted partner, providing unparalleled guidance and services to ensure a seamless and compliant registration process for your business. Partner with us to embark on a journey of financial success and compliance in the UAE business landscape.

Dubai’s Mainland offers a plethora of opportunities for businesses, allowing them to operate anywhere in the city without any restrictions. Our team is equipped with the knowledge and experience to navigate the regulatory landscape, making the Mainland company setup process efficient and stress-free.

Expert Guidance for Freezone Company Setup in Dubai

In addition to Mainland company setup in dubai, Bespoke Strategy Solutions offers expert guidance for Freezone company setup in Dubai. Our Free Zone Experts are well-versed in the benefits and intricacies of establishing a business in one of Dubai’s thriving free zones. Experience the advantages of 100% foreign ownership, simplified import/export procedures, and tax exemptions.

Dubai’s Free Zones are renowned for providing an investor-friendly environment, fostering innovation and business growth. With Bespoke Strategy Solutions, you can capitalise on these benefits as our Free Zone Experts guide you through the entire setup process. From choosing the right Free Zone to completing the necessary documentation, we ensure a swift and efficient setup tailored to your business needs.

Tailored Solutions for Every Business

At Bespoke Strategy Solutions, we understand that every business is unique. Whether you’re a small startup or a well-established enterprise, our team crafts tailored solutions to meet your specific requirements. From legal compliance to visa services, we have you covered, allowing you to concentrate on building your business.

Our Business Consultants work closely with you to understand your goals and challenges, ensuring that our services are customised to suit your business model. Whether you require local sponsorship, assistance with government approvals, or visa services for your employees, Bespoke Strategy Solutions is your one-stop solution for comprehensive business setup support.

In the dynamic business landscape of Dubai, success begins with the right partner. Choose Bespoke Strategy Solutions for a reliable and efficient Mainland company setup in dubai experience. Our commitment to excellence, coupled with a team of dedicated experts, makes us the perfect ally for entrepreneurs, businesses, and investors alike. Contact us today and unlock the doors to success in Dubai, UAE.

Visit our website at Bespoke Strategy Solutions to explore a world of innovative solutions designed to meet the distinctive needs of your business. Our team of seasoned professionals collaborates closely with you to understand your challenges and aspirations, ensuring that every strategy we develop is uniquely suited to drive your growth.

Discover the power of personalized consulting at Bespoke Strategy Solutions, where we blend strategic insight, industry expertise, and creative thinking to create a roadmap for your success. Whether you’re a startup navigating initial challenges or an established enterprise seeking a strategic pivot, our commitment to excellence ensures that we are with you every step of the way.